Breakbulk Cargo vs Bulk vs Container Shipping: Key Differences at a Glance (2025)

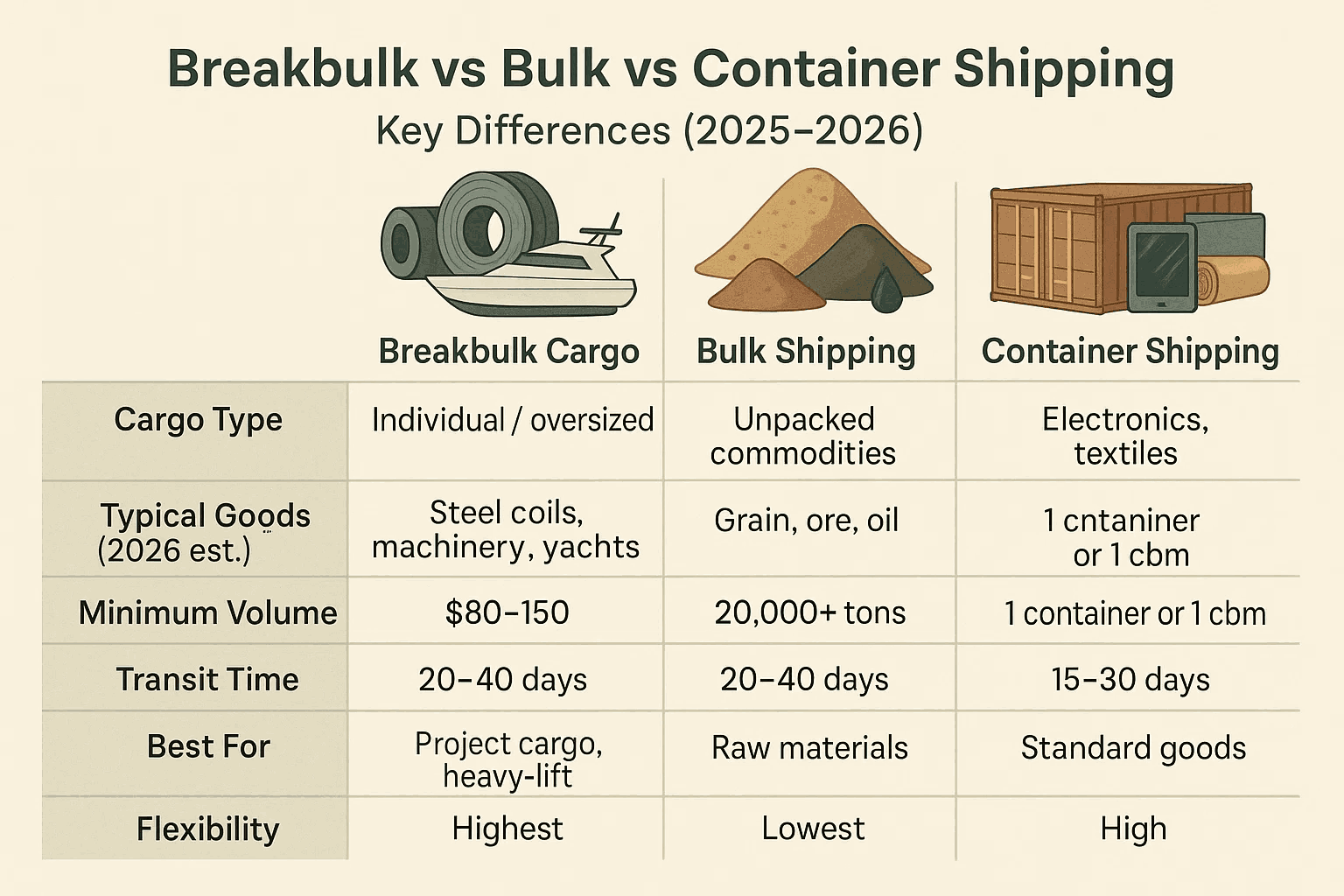

Here’s everything you need to know in one simple table (updated for 2025 estimates based on current market trends from sources like Drewry and Freightos).

Note: All rates are approximate averages per ton and vary significantly by route (e.g., Asia-US vs. intra-Europe), cargo volume, port conditions, fuel surcharges, and forwarder agreements. Always get custom quotes for accuracy—rates can fluctuate 20-50% seasonally or due to geopolitics.

|

Aspect |

Breakbulk Cargo |

Bulk Shipping (Dry / Liquid) |

Container Shipping (FCL / LCL) |

|

Cargo Type |

Individual units, oversized or heavy items |

Unpacked bulk commodities (grain, ore, oil, etc.) |

Goods packed inside 20ft or 40ft containers |

|

Typical Goods |

Steel coils, heavy machinery, yachts, project / industrial cargo |

Coal, grain, cement, crude oil, raw commodities |

Consumer goods, electronics, textiles, packaged products |

|

Packaging / Handling of Cargo |

Crated, palletized or loose — loaded individually or in small batches |

No packaging — cargo is poured or pumped directly into hold / tank |

Fully containerized; standardized container loading |

|

Vessel Type |

Multi‑purpose vessels, geared ships, Ro‑Ro capable ships |

Bulk carriers (dry bulk) or tankers (liquid bulk) |

Container ships (capacity up to ~24,000 TEU) |

|

Loading / Unloading Method |

Cranes, slings, manual labor + specialized handling |

Conveyor belts, grabs, pumps (for liquids) |

Gantry cranes; fast and standardized operations |

|

Transit Time / Predictability |

Medium to slow — depends on handling speed & port capacity |

Usually slow — especially for long sea voyages |

Fastest and most predictable — fixed sailings and fixed schedules |

|

Estimated Cost per Ton (2025, approximate) |

US$ 80–150 (higher for heavy/project cargo; on heavy routes possibly ~US$ 129/ton) |

US$ 20–50 (e.g. roughly US$ 2.5/ton per 1,000 miles; for some liquid or agricultural bulk ~US$ 37–50/ton on certain routes) |

US$ 40–100 (e.g. a 40‑ft container may cost ~US$ 1,800–2,800; assuming ~25‑ton load → ~US$ 45–70/ton) |

|

Minimum Volume / Load Unit |

No minimum — one single item acceptable |

Typically very large shipments (often 20,000+ tons) |

One container (FCL) or even 1 cbm (LCL) — flexible for small-to-medium loads |

|

Best Use Case |

Oversized, heavy‑lift or project cargo, industrial machinery, non-uniform loads |

Large-volume homogeneous raw materials or commodities |

Standardized goods, packaged or consumer goods, high-volume trade |

|

Flexibility (scheduling / routing / consolidation) |

Highest — can handle unusual sizes, non-standard loads, flexible scheduling |

Lowest — needs large shipments; limited flexibility |

High — frequent sailings, established global networks, container consolidation |

In 2025, choose breakbulk when dimensions or weight exceed container limits (despite higher costs), bulk for massive raw commodity volumes (cheapest for scale), and containers when speed, security, and global frequency matter most. But consult a good forwarder to factor in surcharges like BAF ($200–$800/container) or port fees.

What Is Breakbulk Cargo? Definition and Real Examples

Breakbulk cargo, also known as break-bulk or general cargo, refers to goods transported individually as separate units rather than in containers or bulk form. Unlike standardized container shipping, breakbulk items are loaded and unloaded piece by piece using cranes, slings, or manual labor, making it ideal for oversized, heavy, or irregularly shaped shipments that exceed container dimensions (e.g., over 12 meters long or 30 tons per piece).

The process involves custom packaging—crates, pallets, or shrink-wrapping—to protect items during transit on multi-purpose vessels equipped with onboard cranes. While labor-intensive and slower than container methods, breakbulk shines in ports with limited infrastructure, requiring only basic wharves and workers.

Real-world examples of breakbulk cargo in 2025:

- Steel Products: Coils, pipes, beams, and structural components for construction — these shipments are often transported through Iran from countries such as China or Europe to Middle Eastern markets, or transit via Iran to CIS countries.

- Heavy Machinery: Cranes, excavators, and industrial equipment transported in crates — typically routed through Iranian ports for onward delivery to destinations including India, Russia, or other CIS countries.

- Renewable Energy Components: Wind turbine blades, nacelles, and solar project equipment — transported for installation projects in the UAE, India, or Central Asia.

- Vehicles and Yachts: Cars, tractors, and luxury boats shipped on Ro-Ro vessels — can be moved from Iran to China, India, or the UAE, or imported into Iran from Europe or Asia for distribution in regional markets.

What Is Bulk Shipping? (Dry Bulk vs Liquid Bulk)

Bulk shipping involves transporting large volumes of unpackaged, homogeneous commodities directly into a ship's holds or tanks, without containers or individual packaging. In 2025, bulk cargo dominated global trade, carrying about 60% of seaborne shipments—essential for raw materials in industries such as energy, agriculture, and manufacturing. This method is cost-efficient for massive quantities but requires specialized vessels and ports, with rates influenced by fuel prices, geopolitics, and market demand.

There are two primary types of bulk cargo:

Dry Bulk

Solid, granular goods are loaded via conveyor belts, grabs, or hoppers into bulk carriers (e.g., Handysize: 10,000–40,000 DWT; Capesize: 200,000+ DWT). No packaging is needed, though moisture control is critical to prevent issues like liquefaction in ores.

Approximate 2025 rates: $20–$50 per ton depending on route. Common dry bulk cargo includes coal (for power plants), grains (wheat, corn for food/feed), iron ore (for steel), and cement/fertilizers (construction/agriculture).

Liquid Bulk

Liquid bulks are pumped into tankers (e.g., VLCCs for crude oil: 200,000+ DWT; Aframax for refined products). Segregated tanks allow multiple grades to be shipped safely. Rates are expressed in Worldscale or $/ton; for example, crude oil from the Middle East to China may range $30–$45/ton, factoring bunker fuel fluctuations. Typical liquid bulk cargo includes crude oil (for refineries), chemicals (industrial use), LNG/LPG (energy), and vegetable oils (food processing).

Advantages: Typically the lowest per-ton cost for 20,000+ ton loads; simple at dedicated terminals

Disadvantages: High minimum volumes, slower transit, and potential demurrage from delays. Bulk shipping suits raw commodities, and forwarders should be consulted for 2025 quotes.

What Is Container Shipping? (FCL vs LCL Explained)

Container shipping standardizes global freight using ISO intermodal containers (20ft/40ft), enabling seamless transfers between ships, trucks, and trains. In 2025, container shipping handled roughly 20–25% of global trade, ideal for packaged goods due to speed, security, and predictability on mega-vessels (up to 24,000 TEU).

Two main types include full container load (FCL) and less than container load (LCL).

Full Container Load (FCL)

Shippers book and load the entire container (20ft: ~33 CBM, 28-ton max; 40ft: ~67 CBM, 30-ton max), sealed at origin for direct door-to-door transit. Flat rate per container applies, though it is more economical when filled >13–15 CBM. Approximate 2025 examples: 20ft container Asia–US $1,800–$2,800 (~$45–$70/ton assuming 25-ton load), 40ft Europe–Asia $2,500–$4,000. FCL is suitable for high-volume shipments such as electronics pallets, furniture, or other standardized goods, offering faster transit (15–25 days) and reduced damage risk.

Less than Container Load (LCL)

Smaller shipments (1–15 CBM) are consolidated by forwarders into one container and deconsolidated at the destination, paying per CBM (length x width x height / 1,000,000). Rates: $50–$100/CBM + fees (consolidation $100–$200). Example: a 5 CBM shipment from Asia to Europe may cost $400–$600 total, making LCL 30–50% cheaper for very small loads but more expensive per unit than FCL. Typical LCL shipments include product samples (textiles, 2 CBM) or partial inventory (spare parts, 10 CBM). Transit is slower (20–35 days) due to consolidation handling.

FCL offers control and security for large-volume importers, while LCL is suitable for SMEs testing markets. Break-even point is roughly 15 CBM. Forwarders should be consulted for 2025 rates.

Breakbulk vs Container Shipping: Side-by-Side Comparison Table

Container shipping revolutionized global trade with standardization, but breakbulk remains vital for non-standard loads. In 2025, with rising EV and renewable projects, breakbulk volumes may match containers . Here's a focused comparison table for importers/exporters.

|

Factor |

Breakbulk Shipping |

Container Shipping (FCL/LCL) |

|

Cargo Suitability |

Oversized or heavy cargo (e.g., >30 tons, >12m long, project cargo) |

Standard or packaged goods (up to 30 tons per container) |

|

Cost (2025 est./ton) |

$80–$150 (higher labor, but can save on disassembly and handling) |

$40–$100 (economical for large volumes; rates vary by route) |

|

Transit Time |

20–40 days (depends on port handling and lashing) |

15–30 days (predictable schedules on global routes) |

|

Flexibility |

High (custom shapes, specialized cargo, small or less-equipped ports) |

Medium (global routes, but container size limits apply) |

|

Risk / Damage |

Higher (cargo exposed; requires lashing, crating, or protective measures) |

Lower (sealed containers reduce risk; standardized handling) |

Breakbulk excels when containers fail—e.g., wind turbine blades too long for 40ft units—cutting reassembly costs by 15–25%. For standardized goods, containers win on speed/security. Factor in surcharges like BAF ($200–$800) for both.

Breakbulk vs Bulk Cargo: Costs, Use Cases, and Key Differences

Choosing the right shipping method—bulk or breakbulk—can significantly impact costs and efficiency. This table compares cargo types, cost ranges, transit times, and best use cases to help importers and exporters decide when bulk is cheaper and when breakbulk is the better option.

|

Factor |

Bulk Shipping |

Breakbulk Shipping |

|

Cargo Type |

Homogeneous raw materials (unpackaged, poured/pumped) |

Individual units, oversized or project cargo (crates, pallets, machinery) |

|

Cost (2025 est./ton) |

$20–$50 per ton (e.g., iron ore Brazil–China $22–$28; grains U.S. Gulf–Japan $45–$55) |

$80–$150 per ton (higher handling and labor, but can save on disassembly) |

|

Best Use / Advantages |

High-volume commodities; economies of scale; ideal for raw inputs |

Mixed or non-uniform cargo; flexibility for smaller ports; suitable for breakbulk cargo, project cargo shipping |

|

Minimum Volume / Scale |

20,000+ tons recommended |

No strict minimum; flexible for smaller shipments |

|

Transit / Handling |

Requires specialized bulk carriers and terminals; slower (20–40 days) |

Uses general-purpose ports, cranes, slings; handling intensive; transit 20–40 days |

|

Typical Scenarios / Examples |

Coal, grains, crude oil, cement |

Steel coils, heavy machinery, yachts, project cargo |

|

Hybrid Options |

Some geared bulkers can carry minor breakbulk |

N/A |

Advantages and Disadvantages of Breakbulk Shipping in 2025

In 2025, breakbulk remains the only realistic option for oversized, heavy-lift, and project cargo that cannot be containerized or poured as bulk. While more expensive and slower than container shipping, it offers unique flexibility that can actually save money on the total landed cost.

Key advantages of breakbulk shipping:

- Handles any size or weight – even 100+ ton pieces or 80-meter wind blades

- No forced disassembly/reassembly

- Works in almost any port with basic cranes – ideal for secondary or developing ports

- Perfect for mixed or odd-shaped cargo (steel + machinery + spares in one shipment)

- Lower damage risk for delicate heavy items thanks to custom lashing and securing

Main disadvantages:

- Higher freight cost per ton

- Slower and less predictable transit due to manual handling

- Labor-intensive loading/unloading → higher port charges and weather dependency

- Limited sailing frequency compared to daily container schedules

Bottom line: breakbulk is rarely the cheapest per ton, but it is often the cheapest overall solution when containers simply don’t fit.

Advantages and Disadvantages of Container Shipping

In 2025, container shipping will continue to dominate global trade. Its standardization, speed, and predictability make it the default choice for most importers and exporters — especially for packaged consumer goods, electronics, and general merchandise.

Key advantages of container shipping:

- Fastest and most predictable transit times (15–30 days on major like Asia–Europe)

- Lowest damage/theft risk — cargo sealed from origin to destination

- Frequent sailings (multiple vessels per week on major routes)

- Seamless intermodal transfer (ship → truck → rail without repacking)

- Cost-effective for standardized loads

- Easy tracking and digital documentation via platforms like TradeLens

Main disadvantages:

- Strict size/weight limits

- Not suitable for true oversized or heavy-lift cargo (requires expensive flat-racks or breakbulk)

- Congestion and port delays still common (e.g., Los Angeles, Rotterdam)

- Rising surcharges in 2025 (BAF, congestion, low-sulfur fees)

- LCL consolidation adds time and handling cost for small shipments

Bottom line: container shipping wins on speed, security, and cost for anything that fits inside a box — but it fails completely when the cargo doesn’t.

Advantages and Disadvantages of Bulk Shipping

In 2025, bulk shipping remains the cheapest per-ton method for moving massive volumes of raw, homogeneous commodities, accounting for nearly 60% of all seaborne trade tonnage. It is the backbone of global energy, agriculture, and steel industries.

Key advantages of bulk shipping:

- Lowest freight cost per ton

- Massive scale capability — ships carry 20,000 to 400,000+ tons in one voyage

- Simple, fast loading/unloading at specialized terminals (conveyors, pumps, grabs)

- Ideal for raw materials: iron ore, coal, grain, crude oil, LNG, fertilizers, cement

- No packaging costs — cargo is poured or pumped directly into holds

Main disadvantages:

- Huge minimum volumes required — not suitable for small or mixed shipments

- Very limited port access — only deep-water bulk terminals with dedicated facilities

- Slow and less predictable schedules — sailings are irregular, tramping style

- High demurrage risk

- Cargo contamination or liquefaction risks (especially wet ores and grains)

Bottom line: bulk is unbeatable when you move enormous quantities of the same commodity — but completely impractical for anything under 20,000 tons or that requires flexibility.

Conclusion: Which Shipping Method Should You Use in 2025?

In 2025, breakbulk vs bulk vs container boils down to cargo fit: bulk for raw scale, containers for speed/standard, breakbulk for oversized/project wins (despite costs).

Quick picker:

- Bulk: Grains/ores (cheapest volume).

- Container: Electronics/textiles (predictable).

- Breakbulk: Steel/wind turbines (flexible heavy).

Get a free 2025 quote from our forwarders to optimize—reduce risks like delays (up 20% geopolitics). Ready to ship? Contact SASCO for tailored guides.